The Curriculum & Training

At the heart of YESNet’s approach is our “train-the-trainer” model. We empower partner organizations by equipping their staff with the tools, knowledge, and resources necessary to educate clients effectively. This model ensures a sustainable impact, as trusted, trained leaders will continue to foster learning within their communities. This 2-module curriculum package will provide youth with the skills and knowledge needed to perform basic financial management tasks such as accessing inclusive financial services, saving, budgeting, filing income taxes, understanding debt, navigating credit and protecting themselves against fraud online. It’s fully customizable, allowing easy adjustments or removal of modules to meet specific needs. Each module includes resources for a dynamic learning experience:

-

- PowerPoint Presentation

- Facilitator’s Guide

- Workshop Overview, Purpose & Learning Outcomes

This section outlines the module’s objectives and key concepts, clearly defining learning outcomes to measure participant progress and comprehension throughout the workshop. - Interactive Learning Opportunities

The guide features leading questions and a structured agenda that foster discussion and cover all essential topics. It also highlights formative assessments, allowing facilitators to gauge understanding and encourage self-evaluation in preparation for assessment activities. - Workshop Preparation Guidelines

Facilitators receive practical steps for smooth delivery, such as preparing activity materials and polls. A comprehensive list of essential materials and resources, including workbooks, presentations, and useful webpage links, is provided. Additionally, suggested workshop durations help maintain a good pace and allow for adjustments based on participant needs.

- Workshop Overview, Purpose & Learning Outcomes

- Participant Workbook

- Workshop Overview

The workbook includes the workshop agenda, leading questions, and learning outcomes, all designed to enhance participant engagement and deepen their understanding of financial literacy. - Modifiable Format

Available in Word or Google Docs, the workbook allows participants to complete worksheets and take notes during virtual workshops, making it easy to submit their work online. - Takeaway Resource

Participants can retain key information and worksheets, providing them with a valuable resource to reference long after the workshop has concluded.

- Workshop Overview

Financial Literacy, Capability and Inclusion Curriculum

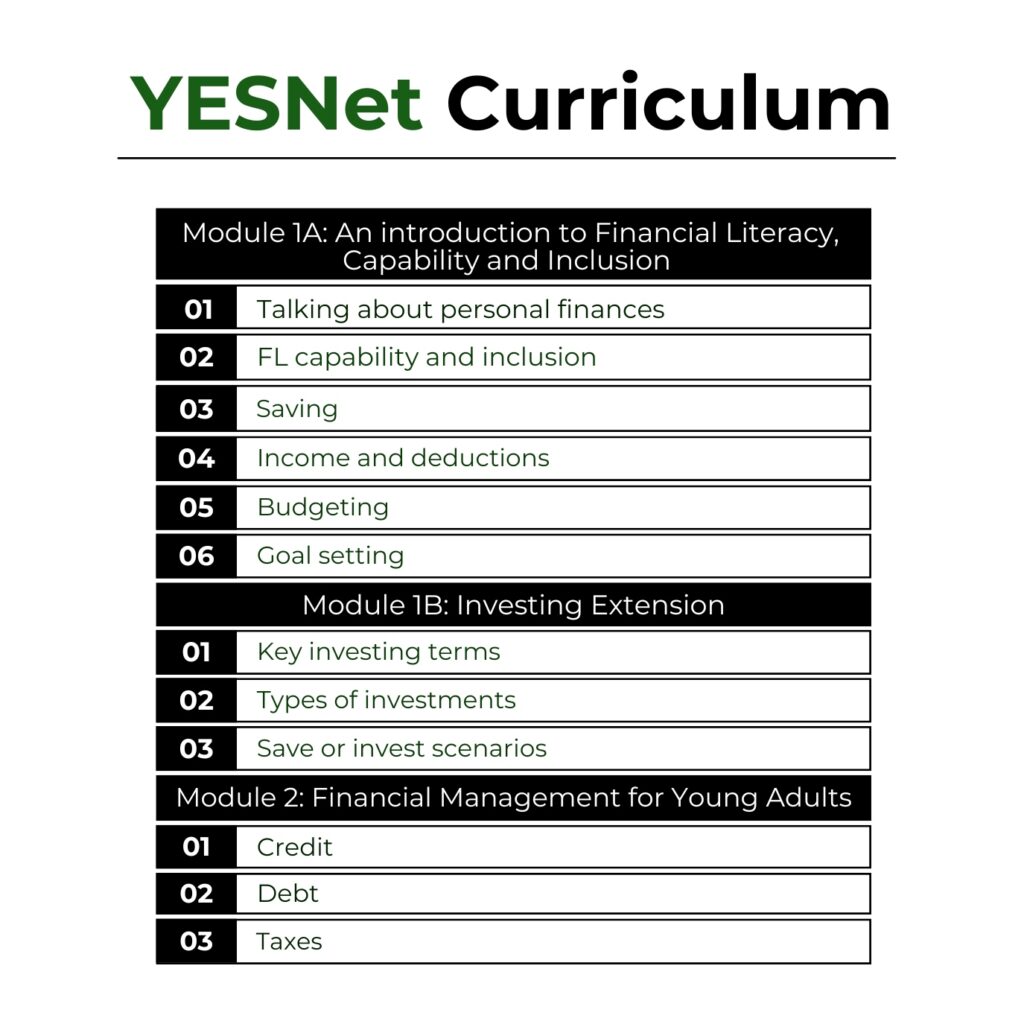

We are excited to announce the addition of a brand-new Financial Literacy, Capability and Inclusion curriculum to its knowledge transfer and training initiatives. Curriculum topics include:

The new curriculum is now available for download for free across the country through the YESNet program. Each of the modules includes a facilitator’s guide, participant workbook and PowerPoint presentation. To access the full curriculum package, email us here.

1. Introduction to Financial Literacy, Capability and Inclusion (extended module including investing also available)

- FG – Introduction to Financial Literacy, Capability, and Inclusion

- Introduction to Financial Literacy, Capability and Inclusion

- PW – Introduction to Financial Literacy, Capability, and Inclusion

The program will not only support organizations and individuals in the Greater Toronto Area, but will also impact and serve people nationally across Canada.

In-person and virtual training sessions for the Financial Literacy curriculum will also be offered to equip staff with the confidence to deliver the curriculum effectively. Each session provides helpful insights on facilitating workshops and practical advice for fully utilizing available resources.

For inquiries about the financial literacy program or to book a training session, please contact Linda Phuong at lphuong@yes.on.ca.

KOFE – Online Learning Platform

KOFE (Knowledge of Financial Education) is a free online platform aiming to empower individuals by bridging the gap between financial literacy & capability. It supports users in confidently managing the complexities of personal finances & achieve their long-term financial goals.

Tools and Resources:

- Free Live Chat with Financial Coaches (via Phone)

- Budgeting Tools & Calculators

- Interactive Courses & Educational Booklets

- Webinars & Downloadable Booklets

To access platform, click here.

For inquiries about the KOFE platform, please contact Linda Phuong at lphuong@yes.on.ca.